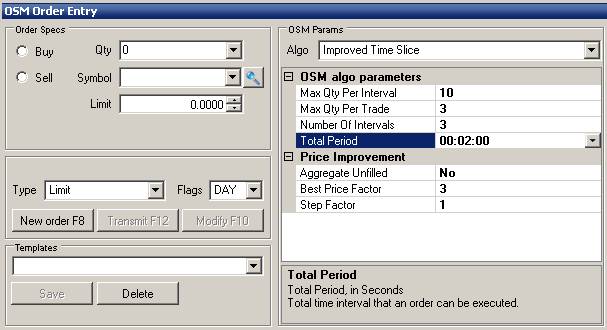

The improved time slice algorithm is used for dividing order execution across a set interval, and has a feature to increase favorable fills by following the market in your favor.

Max Qty Per Interval: The maximum quantity that can be filled in a predefined interval. Please note that if (Max Qty Per Interval) (Number of Intervals) < Lot Size, then the maximum that could be filled is (Max Qty Per Interval) (Number of Intervals) using this algorithm.

Max Qty Per Trade: The maximum quantity each trade will consist of. Must be less than Max Qty per Interval.

Number of Intervals: The number of times an interval is divided into equal parts.

Total Period: Total time period that the order will encompass. Its format is in hours, minutes, and seconds (hh:mm:ss).

Aggregate Unfilled: This will carry over any unfilled order to the next interval. Normally, these are cancelled.

Best Price Factor: The number of ticks from the price specified in the order.

Step Factor: The number of steps used to obtain best price.

Example:

Buy 100 ES @ 751.00 LMT

Max Qty Per Interval: 25

Max Qty Per Trade: 5

Number of Intervals: 4

Total Period: 00:01:00

Aggregate Unfilled: No

Best Price Factor: 4

Step Factor: 4

In this example the order will consist of four (4) – 15 second intervals. The maximum that can be filled in each 15 second interval is 25 until price improvement initiates. Once the 25 is filled the algorithm starts trying to fill using the Best Price Factor and Step Factor. In this example, the algorithm will try a fill a maximum of 5, before stepping down. The algorithm will step down (or up) 4 times (Step Factor) at 4 ticks per step (Best Price Factor).

Important Notes:

All Price Improvement Orders will be cancelled at the end of each interval

Max Qty Per Interval in this algorithm only controls the maximum fill amount for non-price improvement. Thus, in the above example, if 25 are filled and price improvement initiates, the entire order can complete (remaining 75) if prices are favorable.

Aggregate Unfilled will only carry over the unfilled Max Qty Per Interval orders – not price improvement orders. Price improvement orders are cancelled when each interval ends.

Step factors may not be reached if the total quantity is filled before reaching the final step.